|

July 2022 |

|

|

|

Powers of Attorney: General or Limited? |

|

One estate planning document likely to come into play sooner rather than later, for most people is a power of attorney. Powers of attorney allow you, the principal, to name someone else to act on your behalf if you are unwilling or unable to act.

While there are several different kinds of powers of attorney, a financial POA can be used to ensure that you can still manage your bills and other money-related tasks even if you’re not the one executing on those tasks.

Powers of attorney can be given for broad financial powers or for very specific instances. It can be nerve-wracking to name someone else with broad powers to act on your behalf with regard to finances.

With a general power of attorney, you allow your agent to handle any financial issues in your place. This means your agent can do anything you could do, such as making gifts, setting up investments, selling assets, or transferring funds.

|

|

|

There are several examples of situations in which a general financial power of attorney could work well. A spouse, for example, might name their partner under a general financial power of attorney so that the partner has access to all accounts. Likewise, an adult child helping an aging parent with a range of financial tasks might need a general power of attorney to carry out those responsibilities.

However, there are several reasons to consider when it makes more sense to choose a limited or specific power of attorney. If there is no need to grant someone sweeping financial powers in your life, give yourself the peace of mind of limiting those powers to very specific circumstances. Giving someone full authority over your finances could allow them to make decisions that you did not want. Legally, if your POA was general, your agent has discretion on these matters, even if you would not have supported the actions they took.

There are three primary ways to do this: allowing specific actions, limiting the power of attorney to acting in specific period, and naming triggering events.

With specific actions in a limited power of attorney, you grant your agent the ability to carry out one or more specific tasks. For example, you might give your CPA power of attorney to pull your previous year tax returns and speak with the IRS on your behalf. You might give your real estate agent power of attorney to sign closing documents at an out-of-state real estate transaction. With these limited powers, your agent is fully capable of carrying out the task at hand, but you don’t have to worry about potential overreach. You can also use restrictions to limit what they can do, such as allowing them to help with checkbook balancing, but not making gifts.

If you know you’ll only need help during a particular time period, you can give your agent authority to act within that window. This is appropriate if you have an out-of-country trip planned, are undergoing surgery, or have some other short-term need.

Finally, triggering events are those events that must occur in order for your agent to obtain authority over the document. For example, you can declare a sudden illness as an event that enables your agent to take action.

While it’s still important to choose someone you trust as your power of attorney agent, you might feel more comfortable limiting their powers. Discuss your options with an experienced estate planning lawyer for more support. |

Aging in Place vs. Nursing Home Care: Important Factors to Make the Right Choice |

|

|

|

A growing portion of the older population wants to stay in their homes as long as possible. This is known as “aging in place” and has several benefits when it is appropriate for the individual. However, there are some other care concerns to consider when deciding whether someone is at the point of needing additional help.

COMFORT AND FAMILIARITY

Most people want to remain in their homes because of the comfort, familiarity, and memories within it. Moving into assisted living or a nursing home is a big change for anyone, but especially for a senior who feels the loss of their independence during this transition. Remember that, when it is safe for them to stay there, someone’s home can support their overall mental and physical health.

If staying in the same place is important to your loved one, look for ways to ease your mind while also protecting their independence. Is there a neighbor or friend who can check on them each week? Can you drop in every other weekend to make sure things are going well?

SAFETY CONCERNS

Many adult children or other loved ones start thinking about these issues because they’re concerned over safety. Triggering events prompting a conversation about additional care needs include a loved one beginning to show signs of dementia or suffering one or more physical incidents like a fall in their home.

YOUR TIME AND PROXIMITY

As a family member, it’s natural to want to do everything you can to care for a loved one. Caregiving, however, can be very difficult and time consuming. It can be even more challenging if you don’t live nearby. If your time and that of other family members can no longer support a loved one, a nursing home or assisted living may be the answer.

FINANCES

Whether or not your loved one owns their home is the first consideration. Ongoing mortgage payments are just part of the puzzle. It can be hard for people to part with their home, but maintenance concerns and costs can be problematic. Evaluate the age of appliances and yard maintenance required, too. At some point a home might be more trouble than it’s worth to the occupant.

MEDICAL SUPPORT NEEDED

If a loved one only needs help with light housekeeping or meal preparation, they may not need to move to another location, especially a nursing home. Local organizations or a part-time hire could help with these needs while allowing your loved one to stay in their home.

However, if they have more advanced medical needs or challenges with multiple activities of daily living, in-home care from a medical professional could bridge the gap. For more advanced situations, a nursing home might be appropriate.

There are other care options along the spectrum in between care services provided by family and a nursing home. Part-time help from someone local such as a nurse, in-home care providers, assisted living, and adult day care are just a few. For someone who needs extra support but does not require the support of a formal nursing home, these options are well worth exploring. |

Upcoming Events |

|

5 Things all Kids Must Consider as their Parents AgeTuesday, August 2 5:00 PM - 6:00 PM Open Office Zoom – How To Pick Your HelpersWednesday, August 3 12:00 PM - 1:00 PM How Do I Protect My Child’s Inheritance?Monday, August 8 12:00 PM - 1:00 PM Open Office Zoom – How To Pick Your HelpersWednesday, August 10 12:00 PM - 1:00 PM Wills & Trusts 101Wednesday, August 17 5:00 PM - 6:00 PM Generational Wealth & Protecting Your Children's InheritanceWednesday, August 24 5:00 PM - 6:00 PM How to Plan for the Second Half of Life?Thursday, August 25 12:00 PM - 1:00 PM

Register today to reserve your spot!

Additionally, registration for these events is critical so that we can contact you if it is prudent to cancel this session or if we need to change how we are able to offer this to you.

|

A Personal Note From Tiffany |

|

|

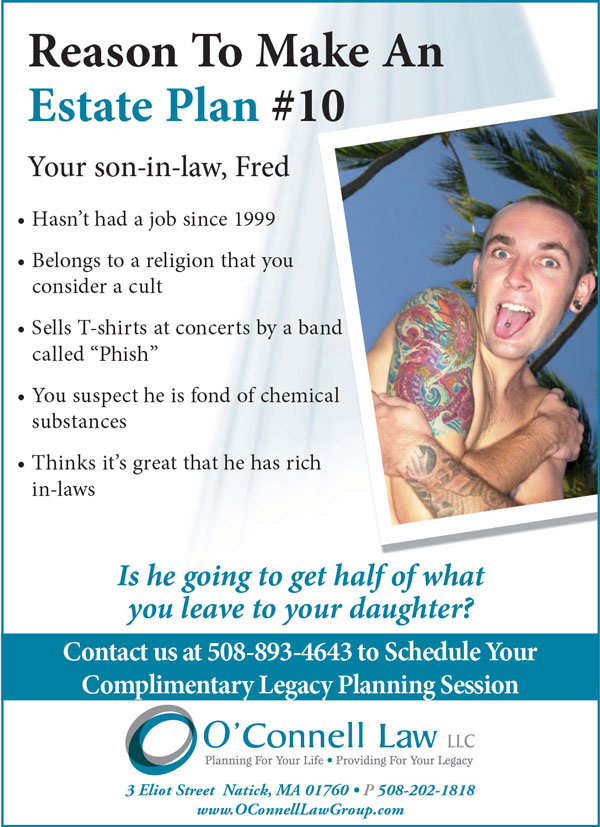

One of the first things I learned when I opened O’Connell Law in 2010 (yup, 12 years ago!) is that marketing is needed to grow your practice so you can help more people. I didn’t learn about marketing in law school – As an attorney, shouldn’t those who need my help just know to reach out to me? Well, unless you let people know what you do and why they may need you, they won’t know that you can help. We have been very fortunate to work with some wonderful marketing companies over the years. One of my marketing consultants, Mark Merenda, created this ad of “Fred” who you see below in this newsletter. Sadly, Mark is no longer living, but his brilliance and creativity live on. I am so grateful to have had Mark in my life and to have helped me over the years.

Mark created this “Fred” ad for his clients over 10 years ago. The ad is meant to be funny and edgy. It makes one chuckle but also stop and think. Although we used this ad numerous times in the past, it just recently went viral on social media. I’ve heard from folks from around the country about the ad (most folks loved it, a few did not). It spread so much on social media that I even got to talk with the “Fred” in the ad. “Fred” is a very nice man named Jeff who said this was a picture of him over 20 years ago. Amazing. Hope you enjoy the ad…and hope it makes you think a bit.

As always, thank you for taking the time to read and reflect.

Sending you all a remote hug, |

|

|

|

|

Don’t forget about our Young Adult Incapacity Plan and that this summer is the time to get that done BEFORE your child goes off to school: |

|

|

|

3 Eliot Street | Natick, MA 01760 |