|

April 2023 |

|

|

|

The Importance of Business Planning |

|

If you already own a business or are considering starting one soon, you are likely exploring strategies to ensure your venture can maintain profitability and staying power. As one of your most valuable assets, any successful proprietorship will require a significant investment of both time and money. A comprehensive business plan is imperative when forming an entity that fosters rapid growth and protects against losses and threats, including lawsuits, termination, tax minimization, and challenging partners and employees. Selecting a suitable business entity is a key component in building a solid foundation.

Sole Proprietorship: For those self-employed individuals who conduct their business on an informal basis, sole propriety may be a suitable option. This is the simplest form of business ownership, as there is no legal distinction between the owner and the business which allows for complete control and responsibility for all profits, losses, and debts.

Partnership: When two or more parties agree to work together either formally or informally, this is called a Partnership. There are General Partnerships, in which all parties share profits, losses and liability. Whereas Limited Partnerships permit one or more of the partners to contribute to capital, share in profit or loss, without playing an active role in business operations. Partnerships can be beneficial for several reasons. They allow for the pooling of resources, skills, and expertise, which can lead to higher profits and offer management flexibility. |

|

|

Corporation: A popular choice for larger organizations is the corporate business entity. A corporation is owned by its shareholders and operated by a board of directors. Corporations are separate legal entities from their owners, which means the corporation can engage in lawsuits, contracts, and own property in its own name. Shareholders hold no personal liability for the debts and obligations of the corporation. They offer significant advantages, including access to capital, limited liability protection for shareholders, and a clear management structure. In order to raise larger capital to finance operations and expansion, corporations can issue stocks or bonds to raise capital, which can then be marketed to investors.

Limited Liability Company: An LLC combines the liability protection of a corporation while maintaining the flexibility and tax benefits of a Partnership. In an LLC, the owners, known as members are not personally liable for the debts and obligations of the business. This means that their personal assets are generally protected from any of the company’s creditors. LLCs are a popular choice for small businesses and startups because they are relatively simple to set up and maintain, and provide the benefits of liability protection without the formalities and administrative burdens of a corporation.

Selecting a business entity can be confusing and stressful as there are several caveats to consider. Seeking the advice of a qualified Estate Planning attorney can offer guidance and clarity for any important decisions regarding your business(es). |

How to Avoid Challenges

|

|

|

Although you may have taken the time to create well structured wills and trusts, there are some common challenges which may present themselves upon your passing. Disputes amongst beneficiaries can result in bitter family relations, costly court proceedings and financial devastation. The following are some proactive measures you can take to avoid common challenges and ensure your documents accomplish your intended goals.

Treat children equally: Certain family dynamics may have you questioning whether your assets should be divided equally. However, to avoid potential complications, equal distribution may be a wise decision. If you have two children, leave each half of all assets. Setting up a trust for a child with bad spending habits can be a useful tool to help protect and manage their assets. This way, a designated trustee will have the responsibility of managing assets for their benefit. The trust may specify how assets can be utilized, establish incentives to encourage good behavior and set access restrictions to prevent erratic spending. Regarding control of your estate, delegate positions according to skill level or select a corporate executor or trustee to avoid anyone from feeling slighted.

Distribute tangible property through specific bequests: While monetary assets can be divided easily, it can be difficult to determine the true value of heirlooms and tangible property. Statements in wills or trust which divide all “tangible personal property” amongst heirs in substantially equal shares may not be enough instruction for your beneficiaries. Substantive value can be based upon several characteristics including emotional and sentimental worth. Discuss this issue with your beneficiaries to determine the personal significance of certain items. By inserting specific bequests into your will or trust, you can mitigate squabbles regarding that antique lamp in the living room or your grandmother’s diamond ring.

Account for gifts given during lifetime: If you gifted money or property to an heir in the past, make sure to account for it in your plan. Since your goal is to treat all your children equally, you might want to address this gift in your will or trust. Classify any gift as an advancement, with the value of the gift counting as part of the “residuary” money you will leave to that beneficiary. For example, if you gave your daughter $5,000 toward student loans, you would specifically state under her residuary share “less $5,000 gifted for student loan payments during my lifetime.”

Insert a no-contest clause in your will: Typically, a no-contest clause will state that if a beneficiary challenges the validity of the will and fails, that beneficiary will forfeit any inheritance they would have received. The clause acts as a threat and discourages those seeking to receive a bigger piece of the pie. If you know a beneficiary is prone to conflict, inserting this statement can prevent heated legal battles and ensure your estate is distributed as intended.

Prove your Competence: Will contesters often claim the maker of the will was incompetent or under duress during the signing of their will. To avoid these allegations, you may want to consider obtaining a medical evaluation which will confirm you are mentally competent and understand the nature and consequences of signing a will. This statement can be included in the will or presented to a court if the will is challenged. Another way to prove competence when signing a will is to have witnesses present at the signing. Witnesses can attest to the individual’s mental capacity and ability to understand the nature and consequences of signing a will. In many jurisdictions, witnesses are required by law to sign the will in the presence of the individual and each other, and to affirm that they believe the individual is of sound mind and not under any form of duress.

Disinherit any heirs: Leaving certain family members out of your will can be a source of contention among beneficiaries. If you are going to disinherit someone, make sure it is noted clearly in your will so there can be no question as to whether you intended to exclude them.

|

Upcoming Events |

|

How to Choose Who Will Fill a Role in Your Estate PlanOngoing The Key Estate Planning Things

|

A Personal Note From Tiffany |

|

|

I’m now on book 14 of Canadian author Louise Penny's, Chief Inspector Gamache series. In February, I mentioned that I can't get enough of those books and the characters in the series (at the time I had just finished book 12).

I’ve only just started reading book 14 (so, no one let me know what happens!). In it, Gamache is a liquidator (the Canadian version of an executor or personal representative under a Will). So, why do I talk about this in the firm’s newsletter? Because in the book, Gamache had no idea that he was named to handle things for the person’s estate. Sadly, this happens way too often.

If you’ve done your estate plan, please make sure to let those who will be helping you know that you have a plan and what you are asking them to do. If you are a client, please give them our contact information. And, as a reminder to our clients, don’t forget our offer to do a family meeting on Zoom with you and your helpers so that we can help you talk about your plan while the waters are calm.

As always, thank you for taking the time to read and reflect.

Sending you all a remote hug, |

|

O’Connell Law Team Updates & News |

|

Faiza’s Family Trip to Pakistan |

|

|

|

|

After eleven years Faiza was very overdue for a trip to Pakistan to visit her extended family! When she found out that two of her cousins were getting married within a week of one another, she planned this special trip that also served as a family reunion. It was the first time her husband and daughter visited Pakistan and they had the best time spending three weeks there in February. There were seven days of celebrations for the two weddings and between that a lot of quality time bonding with both immediate and extended family. During this trip, they were mostly in the city of Lahore but also visited the capital city of Islamabad. |

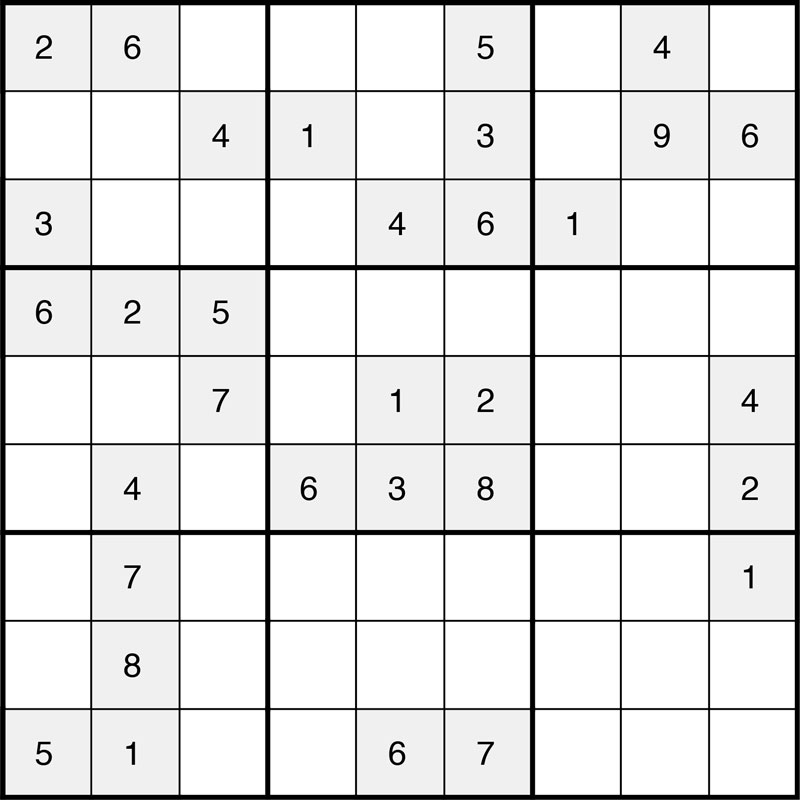

Fun for You Sudoku Puzzle |

|

|

|

Don’t forget about our Young Adult Incapacity Plan and that this summer is the time to get that done BEFORE your child goes off to school: |

|

|

|

3 Eliot Street | Natick, MA 01760 |